MTNN registered record losses in FY 2023 which wiped out its shareholders’ funds.

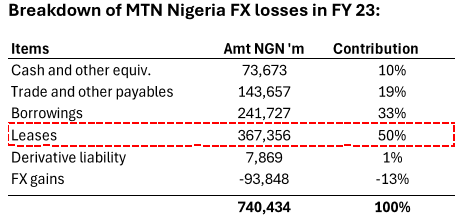

These unprecedented losses were fuelled by FX losses of over N740 billion driven by a c.96% devaluation of the reporting USD/NGN rate from 461 to 907.

Unlike other multinationals whose FX losses were largely due to FX borrowings from their HQs, MTNN’s losses were principally due to self-inflicted supply-chain issues, specifically USD- dominated tower leases (>85% of the total Tower portfolio), predominantly with a Towerco in which MTN Group is a significant investor.

Why is MTNN paying tower leases in USD in a volatile Naira economy? Shareholders are truly concerned because if no decisive action is taken, there could be an irreversible erosion of value especially given the possible outlook of a sustained weakness of the Naira.

We have observed the derisking efforts of MTNN to begin to engage another tower company. But the tower company is an American company with a significant chunk of its tower leases indexed to the USD.

It appears this is a case of moving from fire to frying pan and therefore begs the question: isn’t it time for MTNN to localize its value-chain and processes?

Bracing up for a Difficult FY 24

What’s more concerning is that the USD/NGN rate has as of end-March 2024 weakened ~70% (on average) since December 2023, with likelihood of further deterioration in the year.

- Aggregate FX losses might exceed N1 trillion in FY 2024.

- Of note, given that the N740b losses were booked at an exchange rate of N907/$, it is fair to say that the losses are as good as realized, as it is unlikely for the Naira to appreciate to N907/$ in the near-term.

- Some analysts have referenced MTNN’s robust cashflows (net cash balance of N345b as of Dec 31, 2023) as a reason to not worry much about the current situation.

That cash balance point is very far from comforting for a few reasons

(i) The total cash balance of N345b is still less than the N740b FX loss, much of which would be realized

(ii) the N740b FX loss was generated within a 6 – 7-month timeframe. Would MTNN have had enough cash buffers to cover the loss had it spanned the full FY 2023?

(iii) Would MTNN have enough cash reserves to cover an FX loss of at least N1 trillion in 2024?

(iv) would there still be enough buffers and reserves to absorb any further contingent liabilities including the $47.8m issue relating to a tax dispute with the Nigerian tax authorities?

These are the nagging issues that shareholders are truly concerned about.

The Inevitability of Localization

MTNN has to immediately prioritize a localization strategy, otherwise the future would always remain unnecessarily volatile. Naira-backed tower companies with Naira rates (with no FX indexation) have to be prioritized immediately, otherwise MTNN is on a clear and predictable path to consistent value erosion.

The key inputs of a tower company include financial capital, towers, energy components etc. While some of the components (towers, energy components etc) are unavoidably imported, financial capital is however abundant locally.

- MTNN should therefore prioritize operationally capable tower companies that do not import capital but source theirs locally.

- MTNN should also encourage these local companies by paying them comparable rates to their foreign counterparts. Many if not all of the local tower companies are paid only 20 – 30% of what the foreign counterparts are paid.

- This is a very disturbing and problematic phenomenon on many levels (including in terms of fair business practices), and clearly a deterrent to any localization strategy.

- A robust localization strategy would also animate the local capital markets. Local tower companies are already providing decently attractive returns to their investors despite earning 20.

I implore the shareholders to have robust discussions about the issues at the EGM and we all look forward to more concrete steps in the right direction.

What’s done is done. Time to look ahead and plan for the next 10 – 15 years.

Note: This piece was contributed by a “concerned shareholder” of MTN Nigeria, who has chosen to remain anonymous. At Nairametrics, we are committed to delivering content that is of significant value to our audience, particularly retail investors, and thus, we have decided to publish this article.

Excellent write up! We hope for better years

ahead

Much grateful for this piece.

We hope that you will continue to be our mouth-piece.

This transfer pricing attitude must stop. If no concrete positive forward looking decisions are taken at the EGM, we offload the few units we