In the dynamic landscape of Nigeria’s financial sector, payment switching and processing companies play a pivotal role in enabling seamless digital transactions and fostering financial inclusion.

These companies act as intermediaries, routing and processing payments between various entities, including banks, merchants, and consumers.

Their operations underpin the burgeoning digital economy, driving innovation and expanding access to financial services, hence, it is not surprising that Under the CBN payment framework, the switching license is the highest awarded to any fintech by the Central Bank of Nigeria (CBN).

What is a payment switch?

A payment switch is a company that connects financial institutions to enable the flow of value from one to the other. To facilitate these transactions, a central body is needed to authenticate, ease, and keep a record of them. In the case of Nigeria, the Nigeria Inter-Bank Settlement Systems (NIBSS) is the central switch.

Payment switching and processing companies provide a critical infrastructure for electronic payments, ensuring the smooth flow of funds across the financial system. They connect various participants in the payments ecosystem, including card issuers, merchant acquirers, and payment gateways. Their core functions include transaction routing, card processing, payment aggregation, and risk management, among others.

In recent times, more Nigerian fintechs have been vying for this all-important licence and this has seen the number of players rose to 16 as of now. According to the CBN’s database, these are the 16 companies currently licensed to provide switching and processing services in Nigeria:

Appzone

Payment infrastructure company secured approval in principle to operate under the Switching and Processing license category in May last year. According to the company, the licence enabled it to further expand its transaction switching and processing services which were then offered to banks and fintechs through its blockchain-based payment network, ZONE.

ZONE is the first private blockchain payment network that enables the direct flow of payments from bank to bank while empowering previously excluded financial institutions to participate. It has been adopted by over 16 commercial banks and payment service banks in Nigeria.

Arca Payments Company Limited

Arca Payments Company Limited describes itself as an advanced technology platform created to drive and power Africa’s new digital payments revolution. It is one of the licensed switching and processing companies in Nigeria.

Arca enables financial institutions and SMEs to easily accept and process payments, with a focus on Africa’s thriving payments ecosystem. The company’s products and solutions function in the current fragmented payments landscape, connecting individuals, financial institutions, banks, and businesses to Africa’s digital economy.

ChamsSwitch

ChamsSwitch is a subsidiary of Chams Plc, an indigenous and leading Information Technology solutions company. ChamsSwitch is essentially an electronic Payment Switch that has built a world-class Transaction Switching platform that can process and settle payment transactions efficiently, using globally recognized solutions to aid interconnectivity to issuers, acquirers, merchants, service providers, and other switches (both locally and internationally).

Coralpay

CoralPay was incorporated in 2005 but licensed as a Payment Switching and Processing company by the CBN in 2018. As part of its renewed service focus, the company said it is poised to offer a broad range of market-reliable and secure proprietary technology platforms that provide a range of payment-centric services and solutions across multiple channels.

eTranzact

eTranzact prides itself as Nigeria’s premier payment processing platform and Africa’s leading provider of banking and payment services. The company started operations in 2003 as the first fully operational multi-application and multi-channel electronic transaction switching and payment processing company in Nigeria.

The company offers a wide range of payment solutions, including point-of-sale (POS) terminals, mobile payments, and online payments.

Flutterwave

Nigerian fintech unicorn, Flutterwave, was granted a Switching and Processing License by the CBN in September 2022. The license gives Flutterwave permission to offer customers in the region switching and card processing services, as well as non-bank acquiring, agency banking, and payment gateway services, according to the company.

This also allows Flutterwave to enable transactions between banks, FinTechs, and other financial institutions and can process card transactions, participate in agency banking, and offer various payment services without any intermediary.

Habaripay

The fintech arm of Guaranty Trust Holding Company, HabariPay, is a payment processing company that was founded in 2019. It is a subsidiary of Guaranty Trust Holding Company, one of the largest financial services groups in Africa. HabariPay provides a wide range of payment solutions, including point-of-sale (POS) terminals, mobile payments, and online payments. The company is licensed by the Central Bank of Nigeria (CBN) to operate as a payment switch and processor.

Hydrogen Payment Services Limited

Like Habaripay, Hydrogen Payment Services Limited is the fintech arm of Access Holdings that was established in 2022. The company is licensed by the Central Bank of Nigeria (CBN) to operate as a payment switch and processor. Hydrogen is being positioned by Access Holdings as a platform to drive virtually all of the digital transactions accruing to the group from across subsidiaries from banking to pensions as well as insurance, facilitating cash flow and aiding settlement.

Interswitch

Interswitch is a leading player in the Nigerian payments industry. It is the largest payment processing company in Nigeria and one of the leading payment companies in Africa. Interswitch was founded in 2002 and is headquartered in Lagos, Nigeria. The company has over 8,000 billers aggregated on its Quickteller platform and over 41,000 Quickteller Paypoint agents enabled across Nigeria. Interswitch also processes transactions for over 190,000 active businesses on a daily basis.

Network International

Network International, which operates across Africa and the Middle East, was granted a switching license by the Central Bank of Nigeria (CBN) in 2012. This license allows the company to operate as a payment switch and processor in Nigeria. This means that Network International can connect financial institutions and merchants, enabling them to process electronic payments.

Obtaining a switching license is a significant achievement for Network International, as it allows the company to participate in one of the fastest-growing payment markets in Africa. The Nigerian payment market is expected to grow at a compound annual growth rate (CAGR) of over 20% in the coming years.

Paystack

Paystack is a Nigerian fintech company that provides a wide range of payment solutions for businesses and consumers. The company was founded in 2015 and is headquartered in Lagos, Nigeria. Paystack is licensed by the Central Bank of Nigeria (CBN) to operate as a payment switch and processor. Among other services, Paystack provides a secure online payments gateway that allows businesses to accept payments from customers online. The gateway supports a variety of payment methods, including credit cards, debit cards, and bank transfers.

Remita Payment Service Limited

Remita Payment Service Limited (RPSL) is a Nigerian electronic payment platform that facilitates the transfer of funds between individuals and businesses. It is a leading payment processor in Nigeria, handling over N2 trillion ($5.6 billion) in transactions annually. Remita is licensed by the Central Bank of Nigeria (CBN) to operate as a payment switch and processor.

Remita is a key player in the Nigerian financial technology (fintech) sector. The company’s platform is used by a wide range of businesses and individuals, including government agencies, banks, universities, and retail merchants.

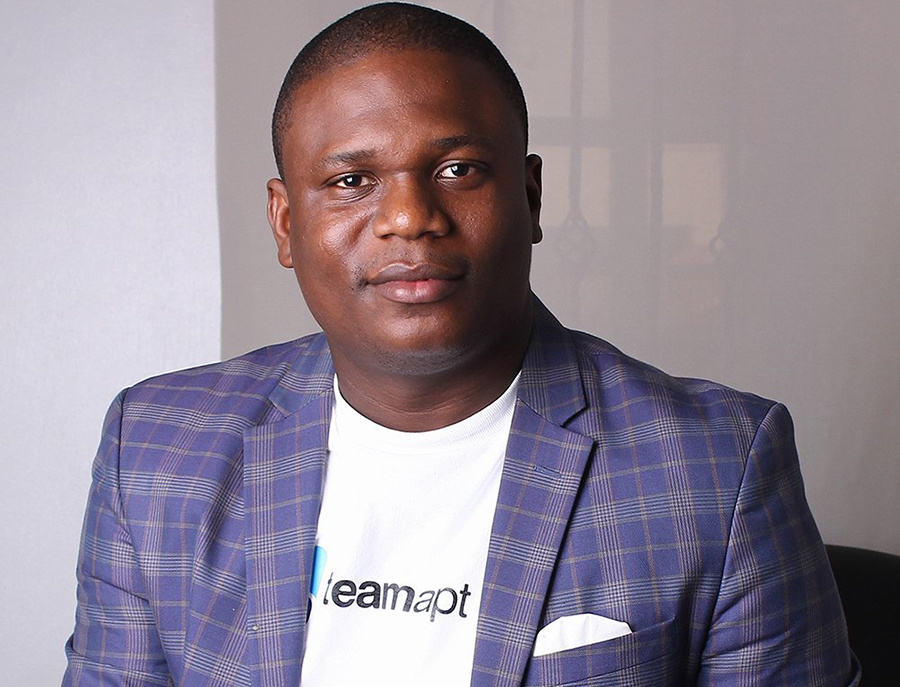

TeamApt Limited (Moniepoint)

TeamApt Limited, now Moniepoint, is a Nigerian mobile money payment platform that allows users to send, receive, and store money using their mobile phones. The company was issued a Switching licence by the CBN in 2019 for one of its products, Aptplay. According to the firm the Switching licence would enable it to serve the finance industry effectively and cater to the needs of its large customer base of 26 banks across Africa, including Zenith, ALAT by Wema, UBA, and First Bank, among others.

Terra Switching and Processing

Terra Switching and Processing was founded in 2021 in Lagos with a vision of being the most reliable and innovative provider in the payment industry. In the same year, the company secured CBN’s Approval in Principle to operate a payment switch in Nigeria. TerraSwitch offers a wide range of payment solutions, including point-of-sale (POS) terminals, mobile payments, and online payments.

Unified Payment Services Limited

Unified Payment Services Limited (UP) is a card-neutral and option-neutral payment service Provider (PSP) founded in 1997 by a consortium of leading Nigerian banks. UP operates as a shared infrastructure for the banking community in Nigeria and a PSP within and outside Nigeria. Its vision is to be the most preferred e-payment service provider in Africa.

The major services and solutions offered by UP include payment Processing and Switching. Payment Terminal Services, Settlement Services, Instant Payments/Transfers, and Merchant Services among others.

Xpress Payment Solutions Limited

Incorporated in Nigeria in 2016, Xpress Payment Solutions Limited (Xpress Payments) specializes in the design, implementation, and provision of platforms for electronic payments, collections, bill payment and funds disbursement. We also provide payment services around transaction switching and processing. In addition to its switching and processing licence, Xpress Payments also serves as a licensed payment terminal service provider (PTSP) to supply and manage point-of-sale terminals.