Lately I have received emails from my readers requesting that I suggest for them stocks which they can buy. Most of them are looking to invest in the long term hoping that the value of their investment would be good enough to pay for their Children’s education, retirement, a project etc.. This in someway is an encouraging news considering that interest in the stock market waned a couple of years ago following the stock market crash of 2008/2009. Despite this I get a bit reluctant to give investment advice regarding stocks preferring rather to have them seek for safer investments.

But before we get to which safe investments are available we need to ask a few questions. How much exactly do you have now? How Much can you put away monthly? How many years do your project for? This questions are very important and you will see why.

Investment Strategy

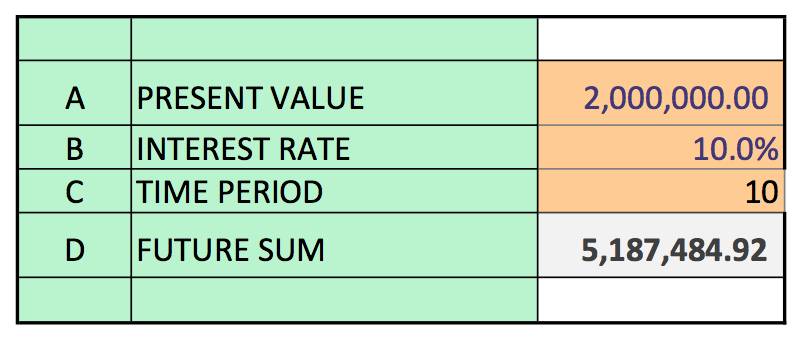

A. Putting a lump sum money aside in an investment

Suppose you have N2million now and decide to invest it in an asset that pays a 10%pa Interest rate. Your plan may be to use the money after 10 years to pay for your children University fees meaning that your investment will be for 10years and you will not withdraw the interest at all and also reinvest the interest.

Implication

By just earning 10% annually on your N2million that amount will more than double to N5.18million by the time your Children are ready for University.

B. Keeping Lump Sum money aside and contributing an equal amount yearly

Some of us receive salary up fronts or some form of allowances from our work place annually. Assuming you receive an advance of N2million yearly and decide to stash that money away annually in an investment that yields 10%pa for the next 10years and also reinvesting the interest.

Implication

The above table shows that at the end of 10 years, your 2million annual contribution would be worth about N35million in 10years.

What type of Investment guaranties these returns?

Again the stock market is not where you want to be if you are looking for guaranteed returns and this is because of the volatility of the market. Luckily, the Nigerian bond market is fairly robust and provide a yield that is equal to and if not more than the 10% interest rate for a 10year bond. Therefore as in A & B above, you can walk up to your bank or investment house and fill up an application to purchase an FGN Bond (How to Invest in Bonds). Please note that the figures above are as a result of the power of compound interest. Therefore to enjoy compound interest you must instruct your bank to re-invest every interest you get in a bond that can offer you a similar rate of return (10%) or even higher. Mutual funds are also a good way to invest however, I am not sure they are able to offer this type of yields constantly for the long term. Fixed deposits with banks are alternatives as well but not as guaranteed and safe as the FGN bonds.

C. What if I want to buy the bonds every month rather than just put out a lump sum?

That is also a good idea and can be a useful form of saving for future projects. For example, supposing you are not sure of how much you need to put aside in buying bonds monthly to be able to have N50million at the end of 10years. At the same annual interest rate of 10% your result is as follows;

Implication

1. What this means is that if you invest N244k every month in bonds that pay 10% per annum for the next 10years that amount will be N50million at the end of the 120months.

2. If the N50million above is all you need for retirement then it means you can actually withdraw N416,666 from the amount every year till you die. And you do not need to even save an inch or even withdraw from the N50million provided you continue to invest in an asset that gives you a 10% return or above every year. All you are doing is just spending the interest (see below);

Finally

The concept above is derived from annuity and compound interest which many of us were thought in secondary school. Achieving this investment goal off course depends on a few factors, some of which are;

1. An ability to find an Investments that can give you a guaranteed return of 10% or above. Currently, only Nigerian Bonds provide this kind of yields for the long term. Though they carry a little risk they are still the safest bet yet. Note that a rate lower than 10% can still give you the future value you desire only that your contribution will be more.

2. Financial Discipline – This is perhaps the hardest part considering the temptation to want to spend. You must stick to your investment goals and develop a thick skin against some of the distraction society can create.

3. Steady Income – You must also have the ability to produce steady income stream that will back your periodic savings. You can achieve this by having a paid employment or by being an entrepreneur or even a combination of both. Without a steady income your goals become difficult to achieve.

4. Stable Government and Economy – A stable Government and Economy is critical to ensuring the government does not renegade on its pledge to repay the bond price at the end of its tenor as well as interest payments periodically.

5. Interest Rates – Interest rates are hardly stable. They go up and down depending on the economy and markets. Whilst some current bond coupon rates are 10% or above one cannot be certain it will remain the same for the next 10 years. This affects your future investment or reinvestment funds. Funds invested at 10% or above will continue to earn that much if you hold to maturity.

Send me an email if you need an excel (as above) template to help you create more scenarios

Thanks for this.

Dear Sir,

I must thank you for this very concise article for laymen like us. I am approaching retirement but as they say “better late than never”. Please kindly send me an EXCEL Template so that I can create scenarios customised to my situation.

Engr. Gerald U. AGWU

Highly illuminating, please help send the excel template..

You are doing a very good job sir.

Please send me the excel template at xtradeanchor@outlook.com. Thank you Banji

Great artcle and very informative as well. I would like the excel template. Thank you.