Did you know the Nigerian economy today is even more favourable to savers than to borrowers and spenders. This is also not a regular occurrence and as usual benefits those who take advantage of it. Why do I say so? The Government today borrows money from investors periodically to pay civil servant salaries, pay for overheads, builds roads and other infrastructure, health care delivery etc. It does this for many reason out of which the most important is cash flow. The government makes money from taxes, share of crude oil sales, royalties, levies and custom duties and dividends from its investment activities. All of these income sources take months and sometimes years to materialise which is why they borrow from you and I. It is similar to the reason why you borrow money with a promise to repay from your future income.

The interesting part of all of this is that the Nigerian Government currently borrows at double digit interest rates. Bonds and even treasury bills pay a double digit interest rate for monies borrowed from you and I. Contrast this with the United States where now is the best time to borrow and spend. Interest rates are at an all time low and the government is borrowing at record low rates that are even close to zero percent. You may wonder why this is so? Why is the Government paying so much just to borrow to spend. Well, a lot of this point to the effect of demand and supply as well inflation. Because not many people are savvy about bonds and other money market instruments that the Government sells there often are fewer buyers.

Government policy also play a crucial factor in all of this and incidentally the policy again is directed at fighting off inflation. The CBN through its monetary policy will typically increase rates at which it lends to banks to be above inflation. This increase also affects the rate at which banks pays its depositors and at which they lend. The stock market is also not a preferred investment outlet for most people because of their experience in the ensuing stock market crash of 2008/2009 leaving most with no option than to spend their cash rather than invest in the money market. Most will rather just buy properties rather than invest in the stock or money market.

Treasury bills and FGN Bonds are by far the safest investment you can find in the country at the moment. They also offer some of the best yields around in terms of the risk and are fairly stable. Even an investment in property can hardly provide the type of yields TB’s and FGN Bonds provide. Rent as a percentage of property value mostly average 5% which even gets further eroded by a higher inflation rate.

Things are even looking to get better following the decision by the CBN monetary policy committee to increase cash reserve requirement for banks holding Government funds. What this means is that banks cannot only use half of the government deposits in their possession creating a cash squeeze that economist believe will lead to higher lending rate.

The turbulence in the western economies also means that Portfolio investments will continue to remain cyclical with cash flowing in and out of the country as the markets react to on going in the US and in other economies like Japan and China. It also indicates interest rate may continue to remain high and the government will have very little option that to borrow at double digits.

Now this won’t last forever as corrections typically occur over time. The question is whether you want to join when the party is over or when it is just heating up. The government will not continue to pay interest rates this high and someday rates may crash too. I don’t know when this might be but if you have loose cash now is not the time to keep it idle in a bank account. Banks expectedly pay less than 5% in savings deposit rate compared to the Government’s 9-11% on Treasury Bills. What they do is take your money and flip it over making double by investing in TB’s. Results from Bank financial statements indicate Nigerian banks made about N140billion in investment income in 2012 alone (about 10% their total operating income).

As with other investments Government debts do possess some risk albeit smaller than its alternatives. Greece for one is an example that is why it is important to follow the news and know how happening around you locally and international can affect governance politically and economically. Government hardly defaults on debt payments particularly to its buyers. Benchmarks such a the country deficit to GDP or borrowing to GDP are readily available for one to use to gauge risk as well.

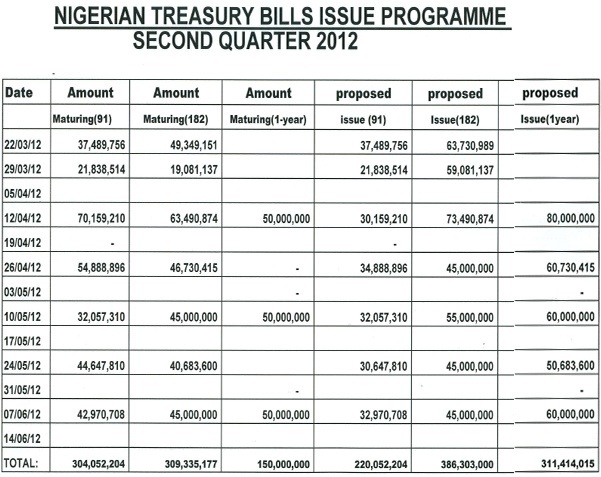

So if you’ve got about N1million and above and have no immediate use of it, invest in treasury bills or bonds. Treasury bills are short term investments and pay about 11% interest per annum. That is N110,000 risk free cash if you decide to buy all through the year. Treasury bills are offered bi weekly and the CBN pays three months interest upfront. Meaning you get three months interest upfront once you purchase. Bonds are also good if you want to invest for one to two years without cashing out. You can also try fixed deposits if your bank is willing to pay above treasury bills rate on your money.

What you should not do is allow your loose cash to remain idle. Cash is king!!