The Pension Fund Administrators are periodically issued guidelines stipulating where, when and how they can invest pension fund assets. These guidelines and regulations are periodically released and updated. Below are approved markets and investable instruments that they can apply the funds to.

Authorized Markets

1. All primary market investments by PFAs in ordinary or preference shares of eligible corporate entities shall only be through public offerings approved by the Securities & Exchange Commission (SEC).

2. All primary market investments by PFAs in bonds, debentures and other debt instruments (excluding Commercial Papers) issued by corporate entities shall be through public offering or private placement arrangements approved by SEC. PFAs may invest in bonds issued by publicly listed companies through private placement arrangements provided they fulfill the requirements in section 5.2.3 of this Regulation

3. All primary market investments by PFAs in participation units of Open, Close-End, Hybrid Investment Funds, including ETFs, and Specialist Investment Funds (REITs, Infrastructure Fund and Private Equity Fund), shall be through public offering or private placement arrangement.

4. All secondary market trading of pension assets, shall take place in a securities exchange (Local and Off- shore) recognized by SEC or a trading facility recognized by the Central Bank of Nigeria (CBN).

5. Exceptions to paragraph 4 of this Regulation are applicable when;

a) Acquiring bonds and securities issued or fully guaranteed by the Federal Government of Nigeria or CBN or eligible MDFO.

b) Trading with participation units of Open/Closed-end or Hybrid Investment Funds on the memorandum list of a securities exchange registered by SEC or a trading facility recognized by CBN; or Specialist Investment Funds (Infrastructure and Private Equity), registered by SEC.

c) Acquiring or trading in eligible securities of a Nigerian corporate entity, which are listed or quoted in an offshore securities exchange, based on prior approval by SEC.

Allowable Instruments

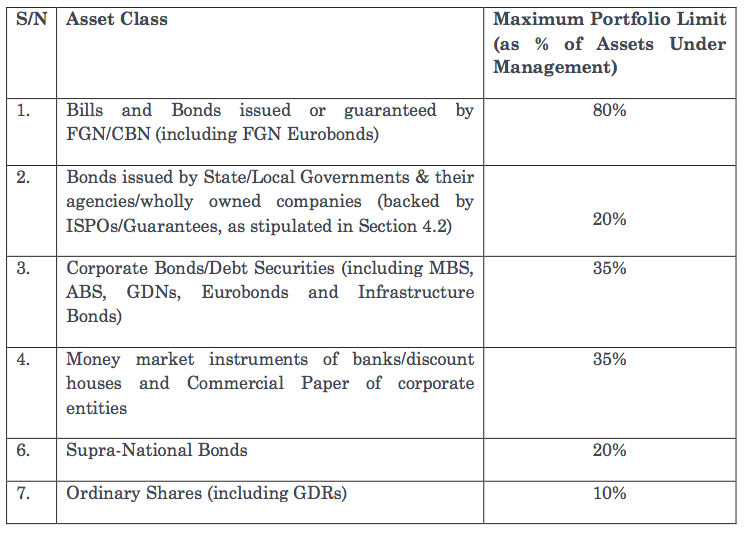

Pension fund assets shall be invested in the following allowable instruments:

Bonds, treasury bills and other securities (including bonds denominated in foreign currencies) issued by the Federal Government and CBN or their agencies as well as special purpose vehicles and companies created/owned by the Federal Government, provided that the securities are fully guaranteed by the CBN or Federal Government.

6. Bonds issued by eligible State and Local Governments or State Government Agencies or wholly owned companies of the State Government, provided that such securities are fully guaranteed by Irrevocable Standing Payment Orders (ISPOs) or external guarantees by eligible banks or development finance institutions or MDFOs with a minimum credit rating of ‘A’.

7. Bonds, debentures, redeemable/ convertible preference shares and other debt instruments issued by listed corporate entities; bonds and debt securities issued by eligible unlisted companies; and Asset Backed Securities including Mortgage Backed Securities and Infrastructure Bonds.

8. Ordinary shares of public limited liability companies listed on a securities exchange registered by SEC.

9. Money market instruments of banks and discount houses as well as Commercial Papers issued by corporate entities.

10. Open/ Close-ended/ Hybrid Investment Funds, including Exchange Traded Funds, which are registered with SEC.

11. Investment Funds whose underlying assets are tangible physical assets. These includes:

i. Real Estate Investment Trusts (REITs) registered by SEC.

ii. Private Equity Funds registered with SEC.

iii. Infrastructure Funds registered with SEC.

10. Supranational Bonds issued by eligible MDFOs.

11. Global Depositary Receipts/Notes (GDRs/Ns) and Eurobonds issued by listed Nigerian companies, as certified and approved by SEC.

Source: Pencom