UPDC Real Estate Investment Trust “the REIT” is a real estate investment trust which invests in the Nigerian property market. Established in 2013, the Trust is closed-ended and listed on the Nigerian Exchange Limited (NGX). Its units can be bought and sold through a licensed stockbroker on the floor of the exchange. The underlying asset of the Trust comprises a diversified portfolio of commercial and residential real estate investments.

The primary objective of the Trust is ensuring stable cash distributions from investments in a diversified portfolio of income-producing real estate property and to improve and maximize unit value through the ongoing management of the Trust’s assets, acquisitions and development of additional income- producing real estate property.

The REIT maintains an investment mix of a minimum 75% Real Estate Investments in Commercial and Residential Properties development, maintenance and rentals, 20% in Real Estate related investments, and ≤5% in Liquid Assets, and is thus considered a moderate risk investment.

The REIT also has an enviable policy it has maintained since inception, to distribute a minimum of 90% of its earnings, semiannually, to unit holders.

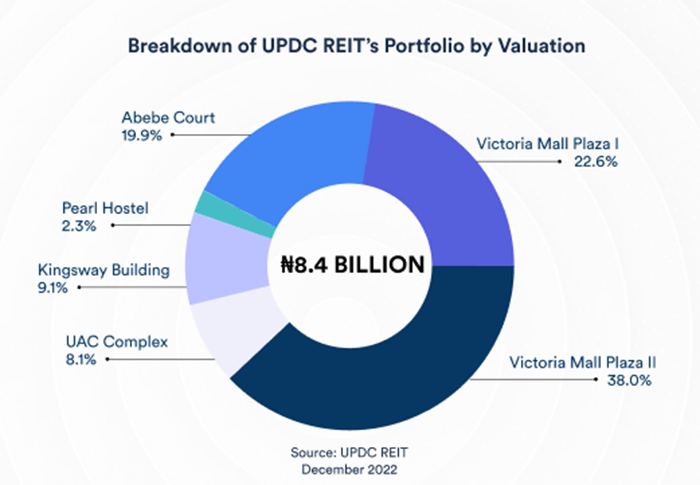

The REIT also lays claim to 6 prime Nigerian properties, with occupancy rates ranging from 75%–100%, namely; 1) Abebe Court, Ikoyi, Lagos, 2) Victoria Mall Plaza 1, VI, Lagos, 3) Victoria Mall Plaza 2, VI, Lagos, 4) UAC Complex, CBD, Abuja, 5) Kingsway Building, Marina, Lagos, and 6) Pearl Hostel, Lekki–Epe Expressway, Lagos

Coming off the tide of a whooping Loss After Tax (LAT) of nearly N5Bil, N4.48 Bil LAT, owed primarily to unexpected losses in foreign exchange conversions for Full Year 2021due primarily, it seems, to COVID restrictions for the period, the REIT bounced back almost 1000% in overall earnings to declare total revenue of N429Mil for Q1 2022. Thus bringing its earnings per unit, EPS, to N0.11k from a dismal N-1.68k full year, FY, 2021.

Regardless, and owing to a robust reserve account in excess of N1Bil, the company was remarkably able to still keep to its policy for full year 2021 and paid a full year script of N0.12k per unit held. The REIT also declared a half year, HY, 2022 interim script of N0.17k off the back of a Total Revenue of N841Mil, Profit after Taxes (PAT) of N541Mil, and an EPS of N0.20. This consequently came to a dividend payout ratio of 85%, and a dividend yield of 5%, all well above, not only local, but global standards.

Two quarters on, FY 2022, and the REIT has declared a total Revenue of N2.16Bil and PAT of N1.57Bil, consequently bringing its EPS to N0.60k (A far cry from its 2019 FY EPS of N0.72k but in step with 2020 FY, N0.63k). Meaning, the REIT has successfully shaken off the global shocks of the COVID pandemic on its path to inspiring profits and policy payouts, once again.

Its balance sheet shows total liabilities of N820Mil against a total asset base of N26.86Bil, thus bringing its total equity to a healthy N26Bil, and a 4.5% increase from it FY 2021 total equity of N24.92Bil. A look at Its Current Ratio from its FY 2022 financials, a measure of the REIT’s ability to offset short–term obligations, Current Liabilities from its Current Assets, shows a 7.16x cover ratio, meaning the REIT can cover its short term obligations by 7x. Well above market standards of ≥1.5x.

Its Returns on Average Assets (ROAA), a measure of how well, the REIT has employed average assets to generate profits for the period under review, FY 2022, shows its managers have been able to generate income from assets by 6%. Healthy, considering an industry average of ≥5%. Returns of Average Equity (ROAE) has grown exponentially, 6.19% FY2022, compared to -16.12% FY 2021. Placing it well above the industry average of 2%-4%.

Its Operating Margins, a function of how much profit the REIT was able to generate from unit sales after accounting for variable costs, stands at 73.8% as compared to its Q3 2022 Return on Sales of 63%. Meaning the REIT has grown it overall capacity, Q–o–Q, to reserve more income from sales by 17%. A clear sign that despite the remote working culture triggered by the COVID Pandemic in 2021, businesses are moving back into the traditional working spaces and these spaces are once again attracting premium consideration and pricing.

As of close of business, 03 Feb 2023, the company was yet to declare a script however with an EPS of N0.60k and an earlier paid interim script of N0.17, it might be safe to project a N0.15k payout, putting total payout for the year just over 50% of total earnings. Well below its payout policy.

Regardless, this will come to a dividend yield of 4.4%, and a cover ratio 4x. Thus, and regardless these healthy numbers, it is more than likely the REIT may offer more to unit holders come declaration day. However, better safe than sorry…

Despite a sharp 8% spike in price during the trading days, 27 Jan – 3 Feb, N3.15k to N3.40k, the REIT is still trading at an attractive Price to Earnings, P/E, ratio of 5.7x, and a Price to Book Value, PBV, of 0.35x, meaning at current price, it is undervalued by at least 65%, thus putting its supposed fair market price, by book value, at N5.62. Its Price to Revenue however puts its fair market price, at N4.19. An average of both projected prices gives N4.90k, an over 40% projected upside. This may go higher should the REIT declare projected or an above estimated script for the FY.

Overall, despite its fluctuating earnings over the years since inception and sharp decline in market value over a five year period (trading at ±N9.00k, 2018), the REIT has consistently delivered on its dividend policy even in the really bad times (FY 2021), and considering better than expected FY 2022 results, this year should be no different.

Also, notwithstanding its slow capital appreciation tendencies, five years to date, its attractive price may hold some short term upside potential thus making it a solid medium term buy and a long term hold for investors looking to bolster their portfolio with solid income paying stocks.

Disclaimer: This report is based on information from various sources that are open but believed to be reliable; however, no, representation is made that it is accurate or by any means complete. While reasonable care has been taken in preparing the information herein, no responsibility or liability is accepted for errors of facts or for any opinion expressed herein.

The data presented herein is for information purposes only and does not constitute any offer or solicitation to any person to enter into any trading transaction based on it. Neither Nairametrics.com nor the author of this document shall accept liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

Brain Essien is a business consultant, with expertise in crowd/start–up funding, business plan/proposal formulation/design and pitch decks.

mcbrainandcompany@gmail.com.