Every quarter, Nairametrics reviews some of the banking sector mobile apps available for downloads at your favorite app stores with the aim of giving you the top 5 banking apps. The mobile banking space is taking shape in Nigeria and is reminiscent of the craze for branch expansion experienced in the mid 2000’s. In place of brick and mortar is mobile banking and apps are in the fore front of this latest initiative to increase financial inclusion.

In this latest review, we look at a list of 7 mobile banking apps that have been released and compare features available for customers to explore. We also take a look at what some of their users have to say about the apps before winding down with our top banking app for the quarter.

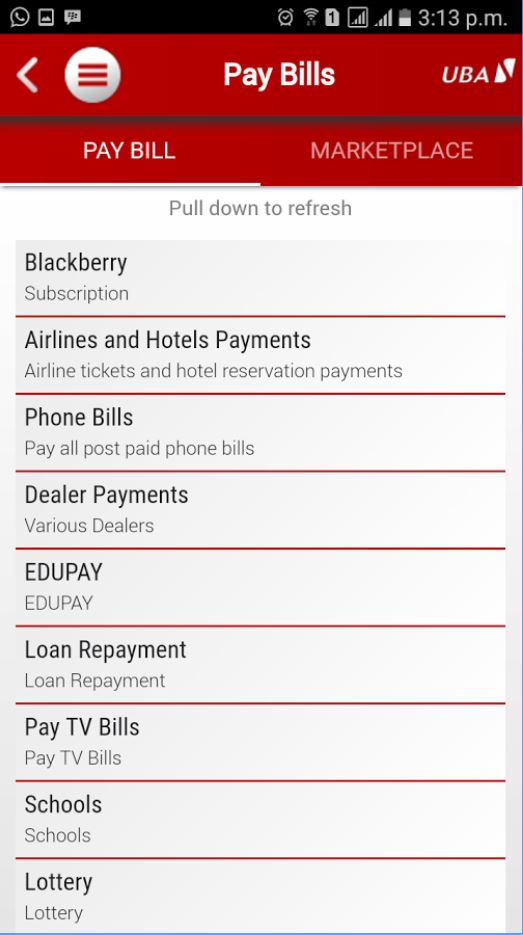

UBA

UBA’s app is one of a kind; a very innovative, well-rounded application for its users. Not only does it care for online demands, the application is somewhat useful offline as well, specifically with providing short codes and answering basic questions on the application’s uses.

The most innovative aspect of the application is the automatic synchronization (syncing) with your device’s security system. This is more evident with the finger print function where the application simply adopts the device’s configuration and all you have to do is enable the finger print function.

Another area where the app’s syncing with the device is very useful is when you try purchasing airtime. Unlike other apps where you have to copy the phone number, the UBA app grants you access to your contact list from INSIDE the app. Considering that airtime recharges are one of the most common transactions on banking apps, UBA’s app should score them several points for this sync.

A last syncing function we must mention is that , you do not have to worry about leaving the app to get your One-Time Passwords (OTPs). The app does it automatically for you. Brilliant, isn’t it?

You can also use the application to run multiple accounts and the payment gateway encompasses pretty much a wide range of payment options ranging from major domestic utilities to some private universities, the Chinese embassy and a number of associations including the Red Cross. (Perhaps a shortcoming will be that in-hall banking services only have to do with cheques and not cards.)

Users’ Perspectives

Despite these unique attributes, the app does not seem popular among its customers. It has received only 500,000+ downloads on the Android PlayStore, which is the lowest range among this edition’s participants. But, among those who have the app, it is rated fairly high at an average of 4.0 out of 5.0. This is the second lowest rating among the 5 apps reviewed in this article.

A critical look at the comments will show that majority of the 5-star ratings are without comments. (Could these ratings be from users who simply want to be left alone by Google?)

At the other end of the scale, most of the 1-star ratings revolve around problems with the recent updates. Complaints range from inability to sync their former details to mal-functioning, and in some cases, non-functioning of key features of the app.

Sample 5-star comment: “The app is very good. Why are people complaining? As far as I am concern[ed], the app is ok” Taofeeq Hassan

Sample 1-star comment: “Was loving this app till this recent upgrade. Please revert to the old version before I lose my mind. I can’t even use account and if I manage to, I can’t use the favorite list or otp…Same prompt… ‘unsuccessful’! [What’s the matter?]” EmeEdim.

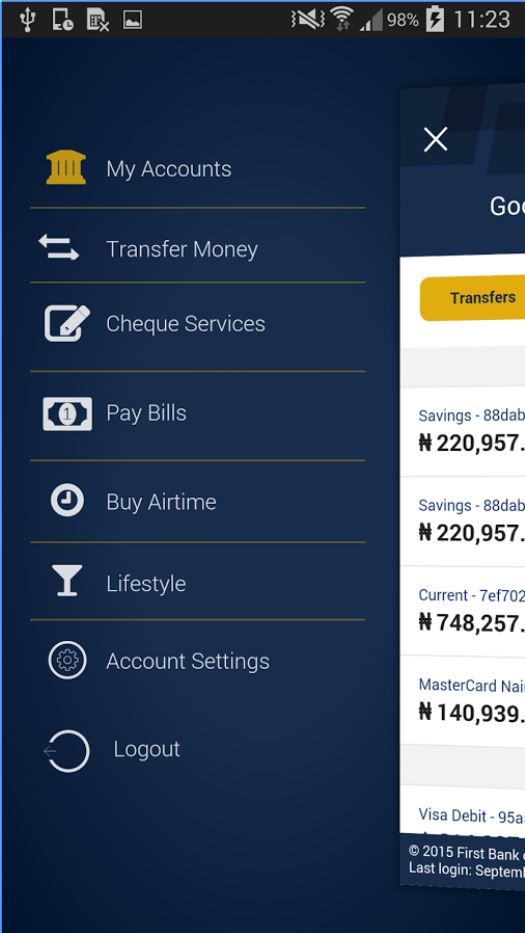

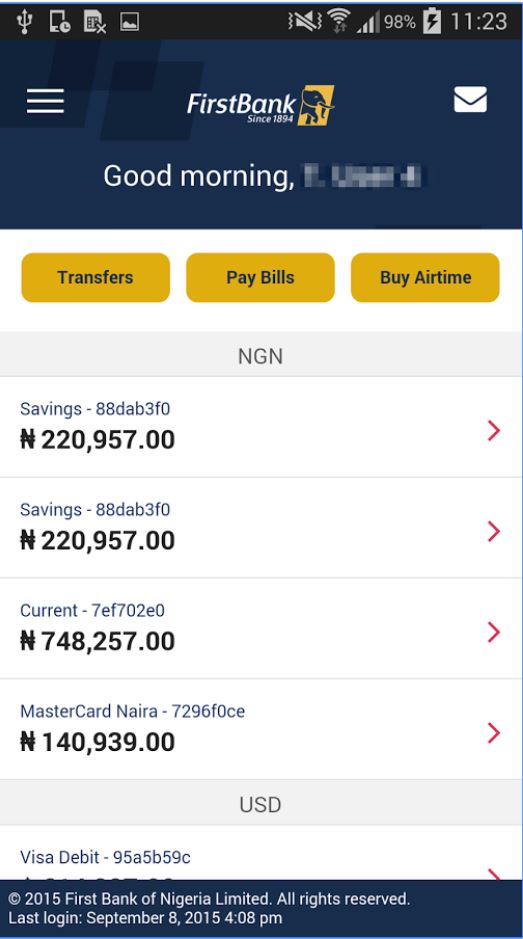

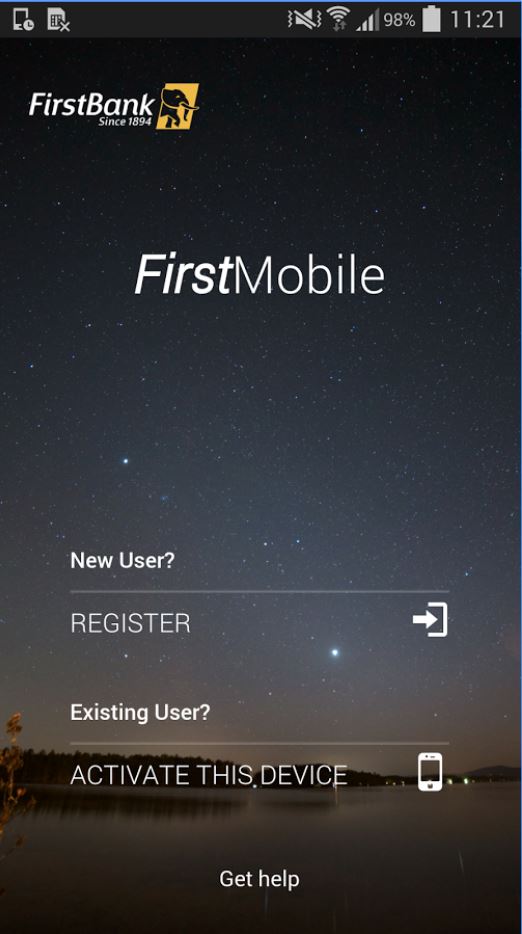

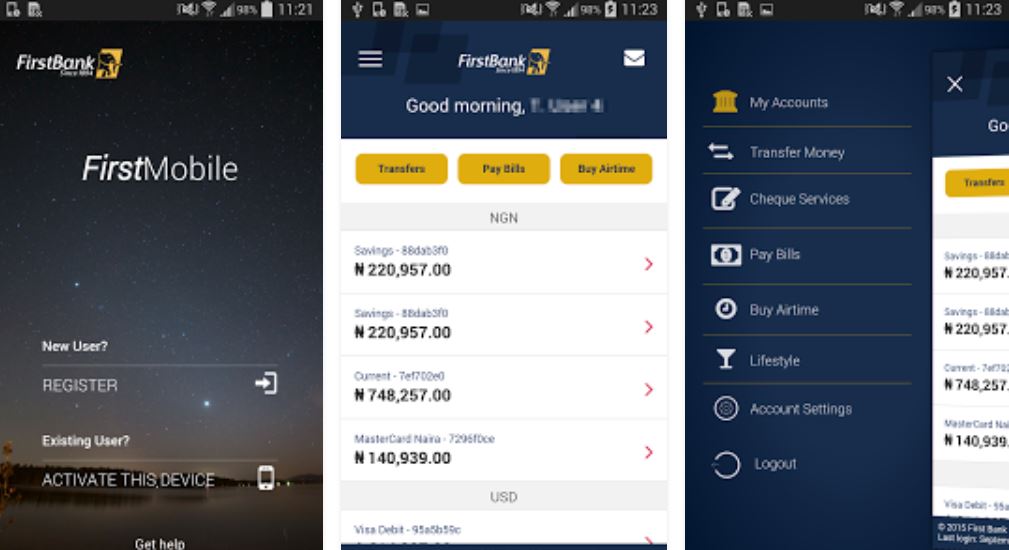

First Bank

Due to its relatively easy set-up, this app will successfully run for Customers’ Favourite. Also, the beauty of its User Interface (UI) easily sets it apart from other contestants in this edition ; with soft, inviting hues, the app is pleasant look at.

Navigation is as simple as it gets with minimal clicks required to carry out common transactions like transferring funds or recharging airtime.

However, the Personal Identification Number (PIN) for logging in is different from that for transactions ; an innovation meant to improve the safety of using the app.

The most innovative thing about the app is the inclusion of the Quick Response (QR) payment option. This will be a favorite for people who love to shop but do not like to move around with their purses.

Perhaps the only discouraging feature is the presence of adverts on the app. Although the ads are tailored to First Bank’s products and can be disabled, it remains a controversial inclusion that will have users divided. For some, it is one thing to receive mails and texts on your banks products and services all the time and another to have them on the app still.

Users’ Perspectives

As predicted earlier, the app is a favorite with over a million downloads on Play Store alone and an average rating of 4.3 among users,; a high point in this edition. With over 11,000 reviews- the most reviews of the 5 apps compared today- the fact that the bank has over7,700 giving 5-stars should be a testament to the functionality of the app.

An in-depth review of the comments show that we have more insightful 5-star comments, with customers specifying exactly what they love about the app. For many, the QR payment inclusion is it while for others, it is the seamless functionality.

However, complaints exist and many are related to the inability to login to the updated version and issues with beneficiary lists.

One particularly disturbing comment observed was a complaint that it is possible to login to the same account on several devices at once. Security-wise, this is a no-no, considering that Nigerians lose or sell their phones rather frequently. If true, this is something that the bank needs to look at.

Sample 5-star comment: “The recent update is a lot better and more reliable. For now, I think it’s the best mobile banking app I have used so far though there is still room for more improvements. Keep up the good works.”

Sample 1-star comment: “Inaccurate app. When you transfer money once, in a few minutes you discover that the [app] has transfer 2 or 3 times”

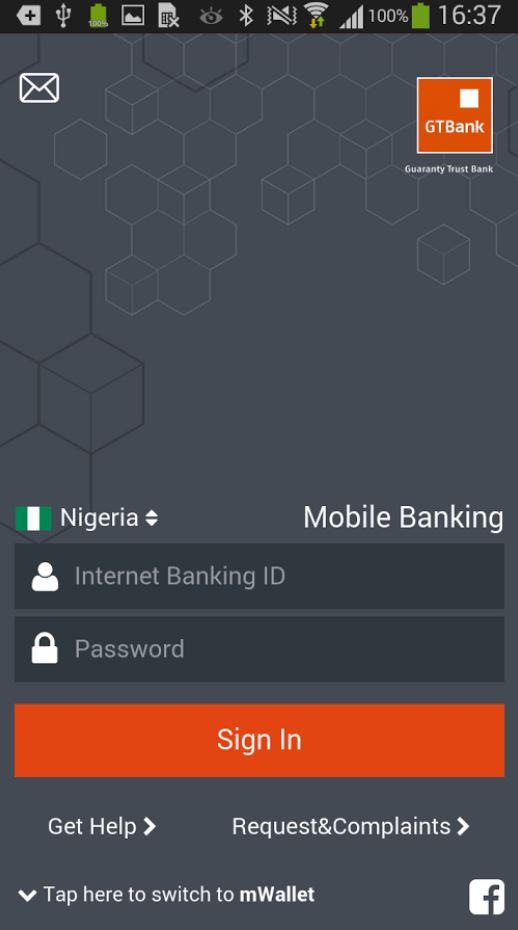

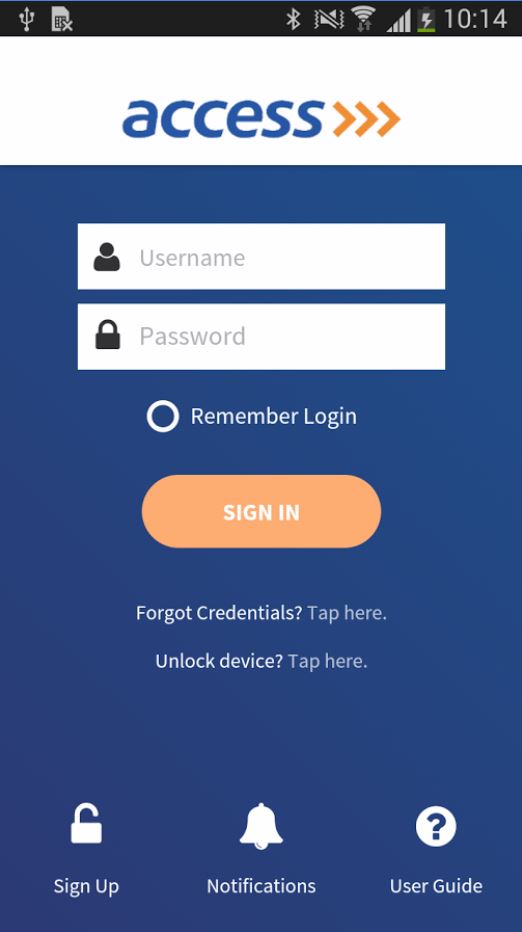

GTB

As an opening note, the process of registration is really tedious. The bank may have overstepped the borders in its attempt at ensuring security. Having to enter the eighth digit on your debit card in a tab then moving on to five more tabs asking for other random numbers on the customer’s debit card is excruciating.

The amount of time spent on registration alone could be used to activate the USSD function and perform about three transactions ;this could be a major turn-off for the average customer.

One very convenient thing though, is that you can purchase airtime without even logging in..

GTB has always been known as a bank with an eye on the youth market segment and this reflects on their app; as much as you can use the app to pay for bills, there is the addition of opportunities to indulge in social activities like paying for cinema tickets and the likes, which is a major plus for millennials. .

The unusually bright Graphical User Interface (GUI) may be appealing to some, but could also be very distracting- and odd- to others.

Users’ Perspectives

With over one million downloads, this is another popular app. This is really not unexpected with the high number of new generation customers the bank has. The app received an average 4.1 rating among the reviews, which is the mid-point rating among this edition’s contestants.

General concerns relate to registration process, which many users claim is long, tedious and in many cases,simply does not work. Another common concern was that OTPs hardly work on the app despite being entered within the stipulated time frame.

Fans of the app love its ease of use ., while some still think the use of tokens makes the app very secure.

In all, for almost 7,700 users from about 14,000 to give the app 5-star ratings indicates that the app is quite useful and should be worth a try despite the issues mentioned.

Sample 5-star comment: “I take my bank to any and every where”

Sample 1-star comment: “It’s been forever waiting for sms secure code to get to my mail. Also used other provided alternative. Awful”

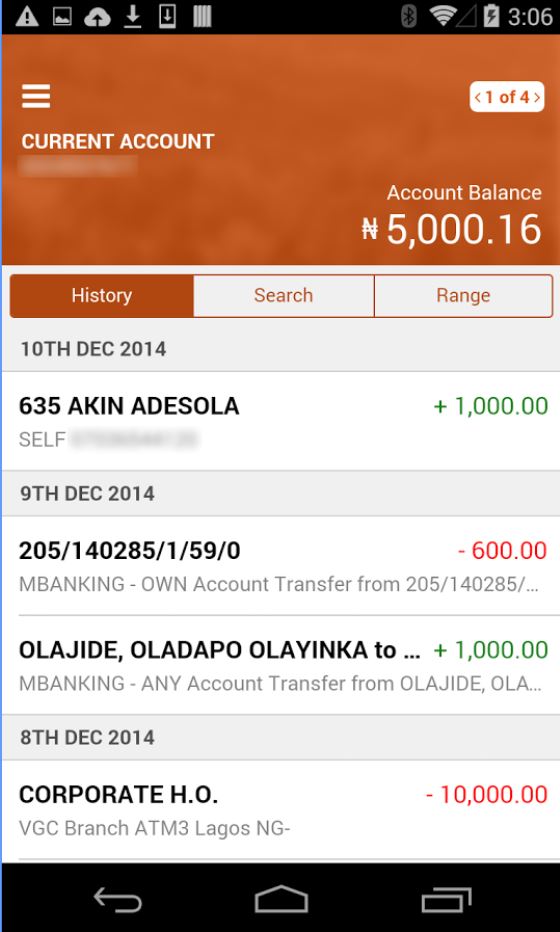

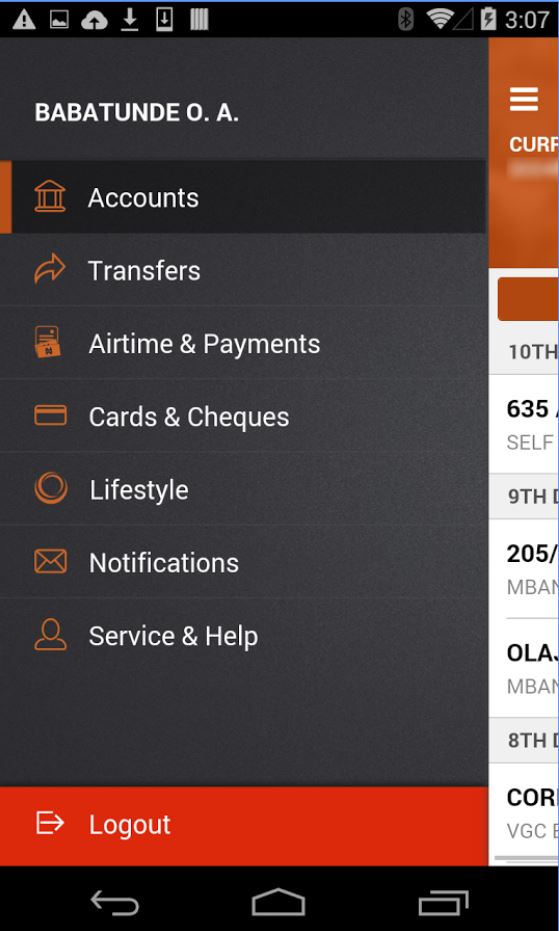

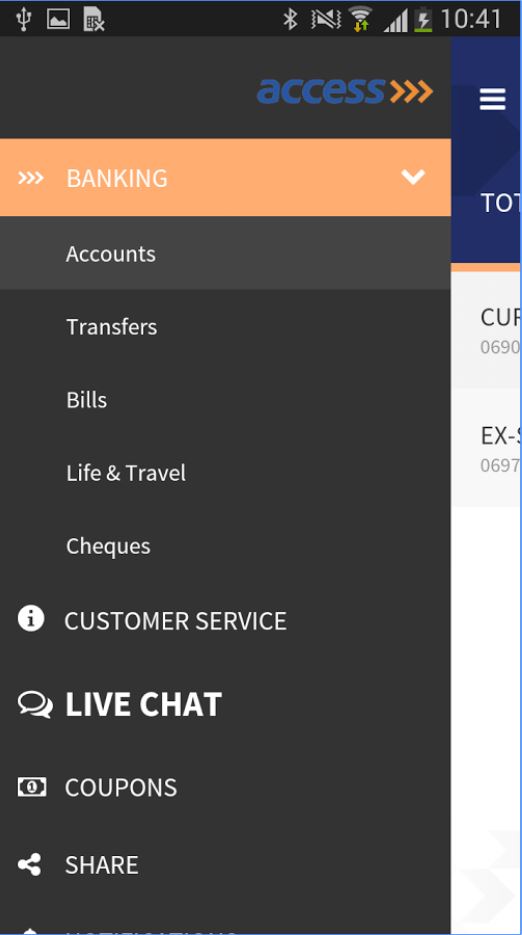

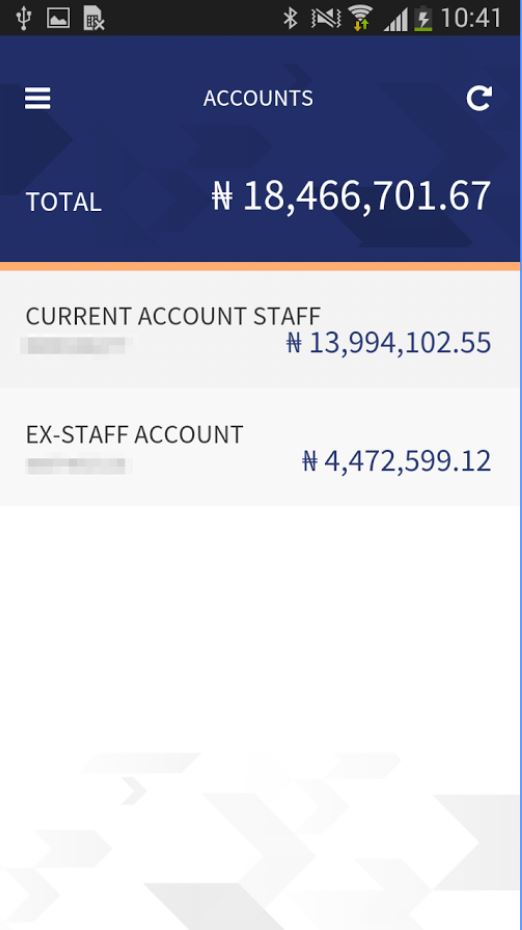

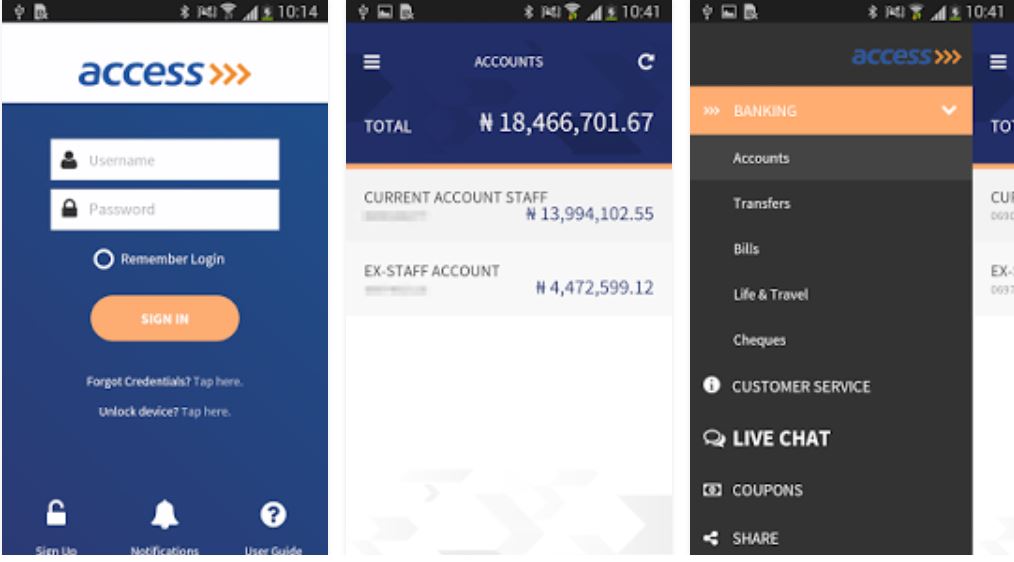

Access Bank

It would appear that the bitter-sweet relationship this bank has with its customers extends to the app. Although the app gets the job done, it is fraught with too many technical glitches. Some days, connecting to the bank’s server can be easy and other days, it becomes a serious chore.

The app has also been upgraded to allow the fingerprint security feature but this remains a cause of headache to several users who claim it does not work smoothly.

Undoubtedly, the app eliminates a whole lot of unnecessary questions and on a very good day, transactions are very fast. The most innovative aspect of this app would be the transaction receipts which are usually produced at the end of every transaction.

Another great feature to note is the inclusion of having a live chat with a customer service representative of the bank via the app. This eliminates the hassle of eithercalling, mailing, texting or tweeting at the bank on social media (Twitter).

Users’ Perspectives

Another app in the 500,000+ range on Android Play Store, the Access Bank app is also, not your most popular app. It however scores a 4.2 rating from a little over 6,000 reviews, which could indicate that it is deemed satisfactory by the majority of users.

A critical look into comments made does little to show exactly what strengths and weaknesses the app has. Almost every feature of the app had a few reviews complaining about it, from logging in to making transfers and getting your transaction history. While some 5-star reviews still have comments suggesting the app needs certain fixes, others are satisfied with its performance. Those who rated the app poorly go on to make their complaints.

While it is typical in the Nigerian setting not to be praised for doing well but be scolded for a few glitches, the variety of complaints should be worrying to the bank. Another weak point is the bank’s seeming reluctance to engage with reviewers on the Play Store. Hardly was any comment replied to by the bank’s staff.

Sample 5-star comment: “Very very cool app but it doesn’t store up transactions history which is very bad [.] Apart from this, I think the app is quite cool”

Sample 1-star comment: “It’s easier to pass a camel through the needle than to login to this app”

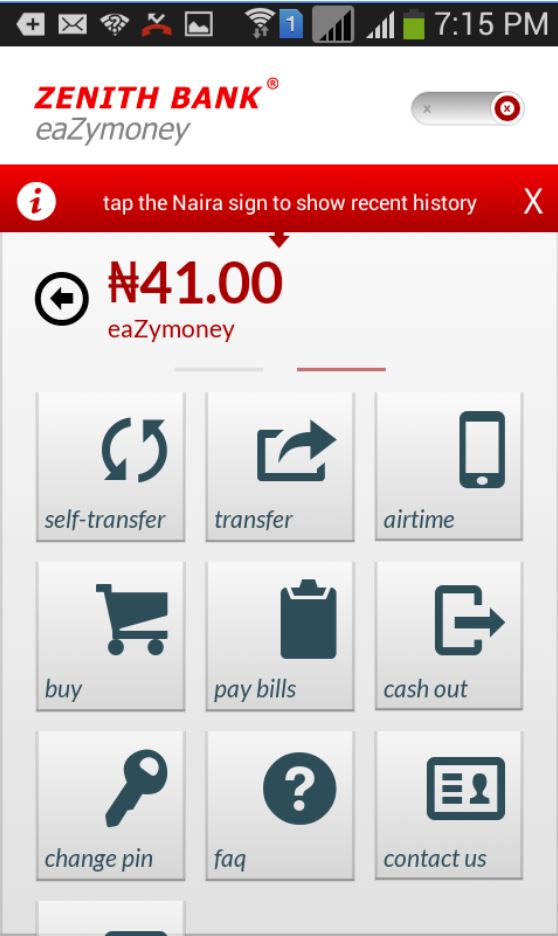

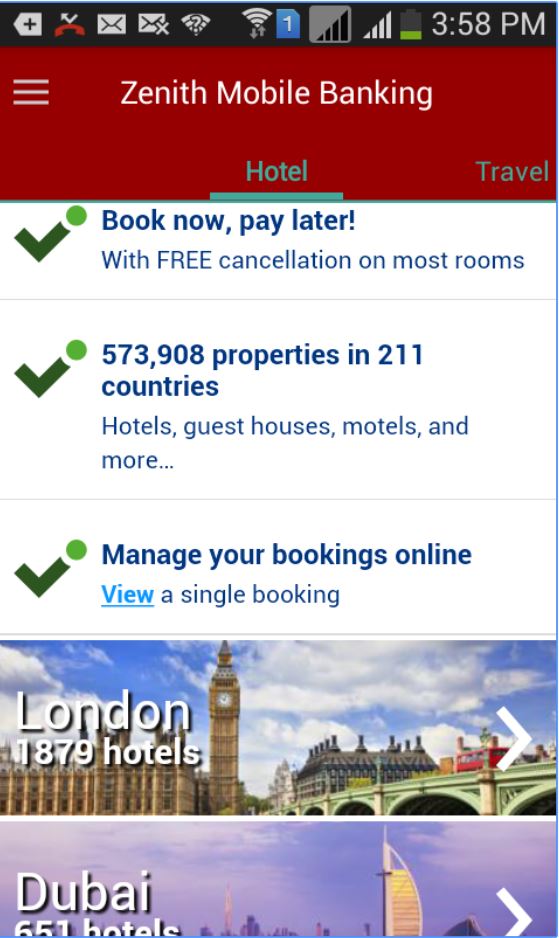

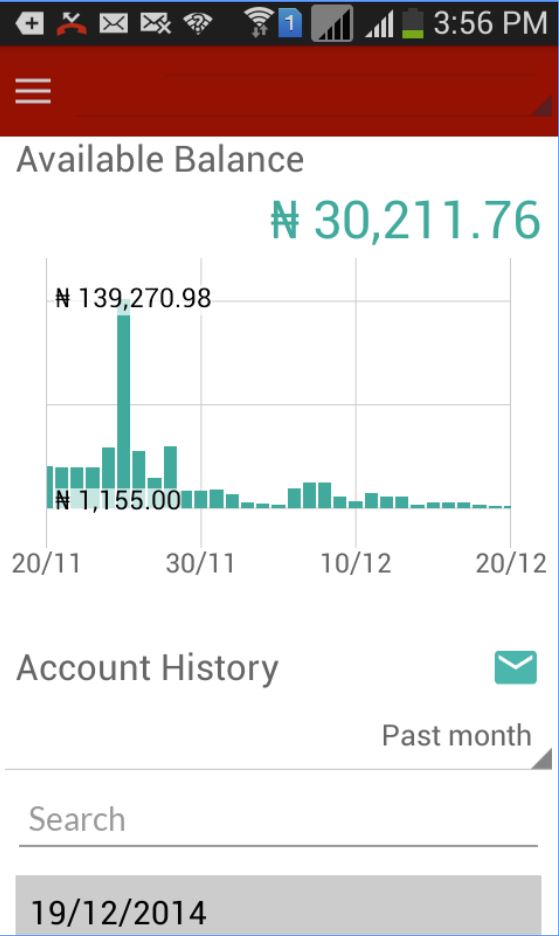

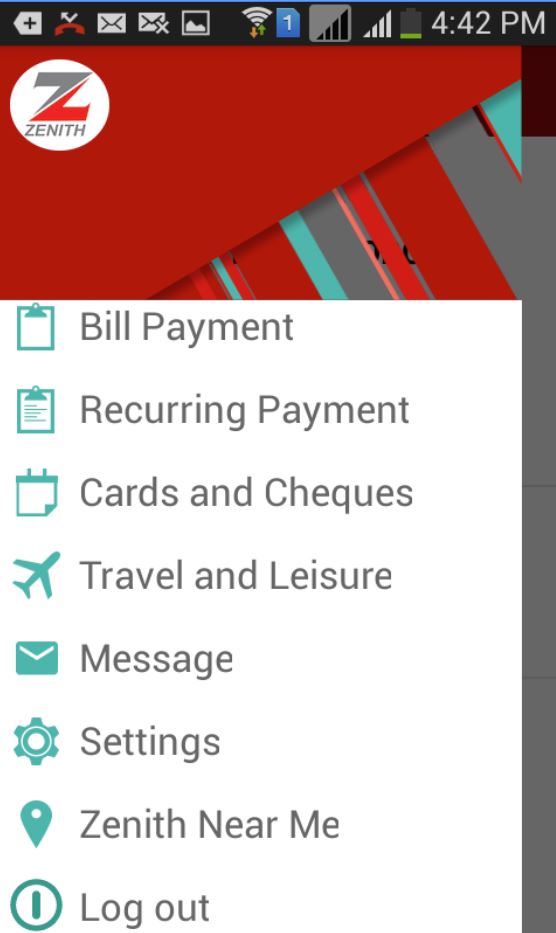

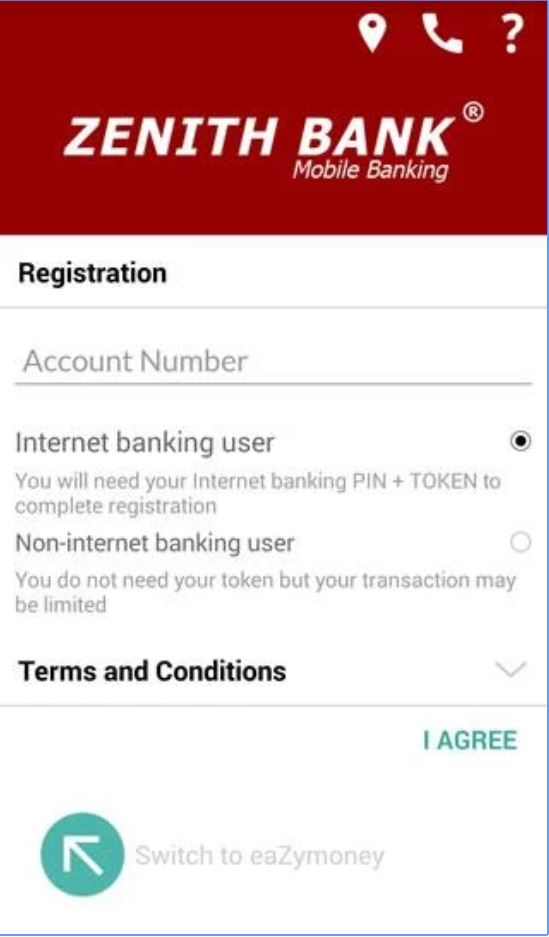

Zenith Bank

The simplicity of this bank’s interface says a lot. It makes the app easy to use and straight to the point. It is easy to register except when it comes to internet banking users who require a hardware token and internet banking pin. This actually may be excessive because the idea of having an application is to put your bank in your pocket. However, security wise, it is quite appropriate.

Perhaps, the most innovative feature of this app is the saved recurrent expenditure. This simply means that it is possible to program some recurrent expenditure and the application would automatically authorize the transaction when the time comes. This would probably be very useful for payment of monthly utility bills and other usual bills that a user pays at a given period of time which is fixed and continuous.

Users’ perspectives

For a bank as popular as Zenith Bank, one would have thought it would have little issues crossing the 1 million downloads mark. Still, as at the time of writing this article it had not. Whether this is due to the customer makeup of the bank, the bank’s publicity strategy or the app’s performance, no one can readily say. What we can say is that, among the less than 6,000 reviews of the app on Play Store, the app gets an average rating of 4.3, a high point among this edition’s participants.

Another strong point is the interaction of the bank with its reviewers. They were ready to sort out problems and replies were not stereotypical copy and paste, but rather tailored to individual comments.

A common complaint though was the inability of users to confirm beneficiary details for funds transfers. However, some other reviewers were quick to shoot this down as untrue.

Sample 5-star comment: “This app is simply spectacular. Zenith bank all day everyday. Network caused a transfer to pend but the money was refunded to me within 2 hours. If [that] isn’t fab service I don’t know what is. Thanks Zenith”

Sample 1-star comment: “Sucks. Terrible just terrible…why do I need to transfer before I can load airtime”

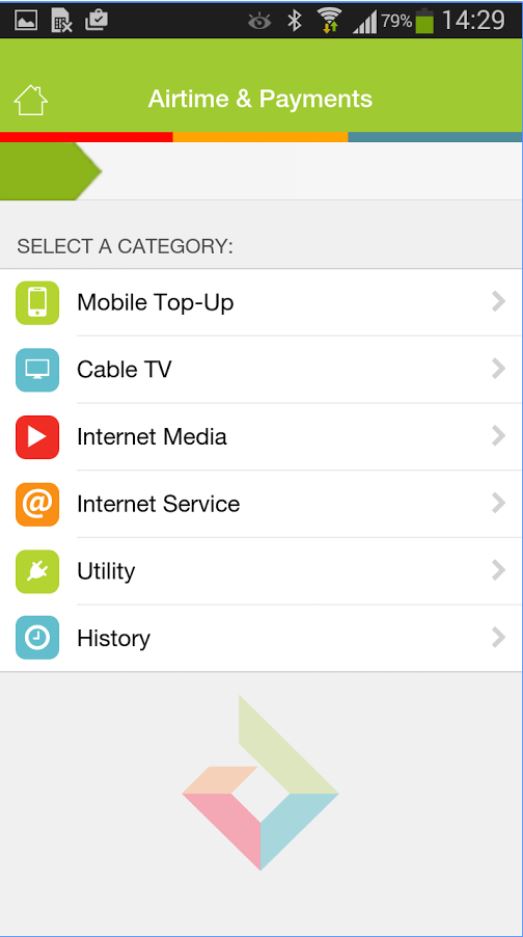

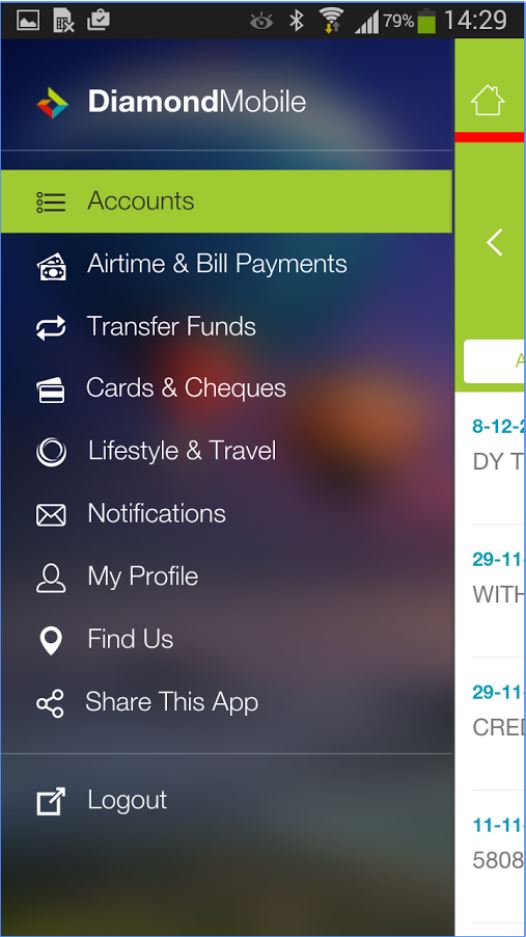

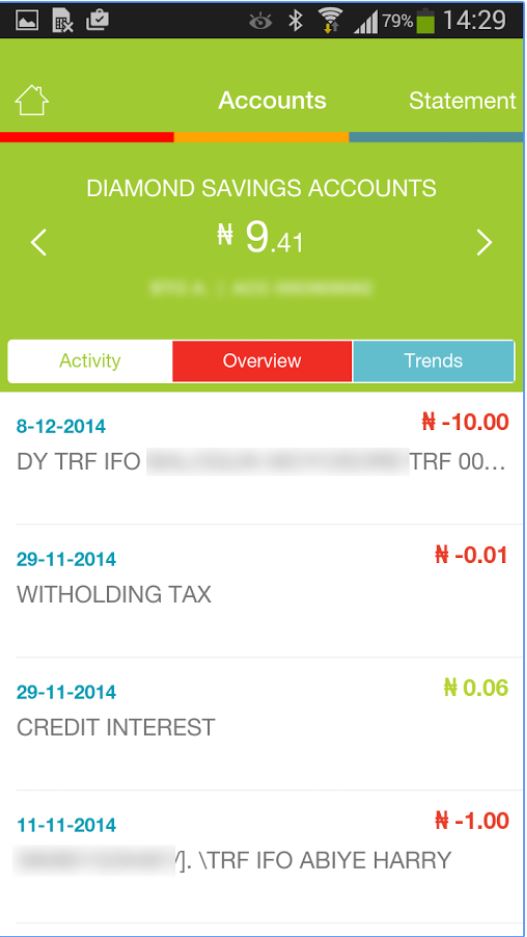

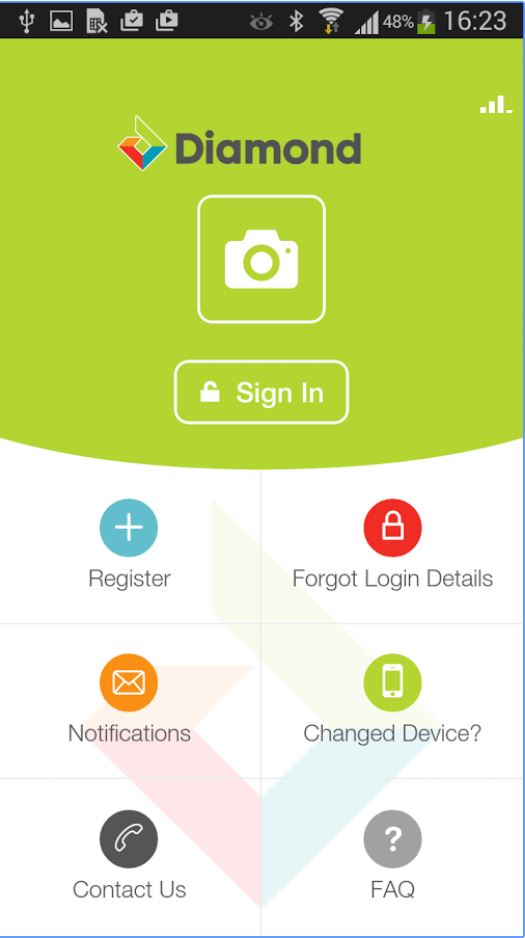

Diamond Bank

Diamond Bank’s mobile app is another top quality mobile application that boasts of several innovative features. The snap overview of transactions available in the ‘Trends’ section of the app which, using bar charts summarizes income and expenditure levels for the past 3 months is an example. Another attraction to the app is its attractive Graphical User Interface (GUI).

Also, the app enables users to carry out certain extra actions such as buy movie tickets while its new Quick Response payment option (mVisa) will make this app a must-have for trendy customers who do not appreciate the constraints of carrying wallets.

As is now becoming an expectation from all bank apps, the Diamond Mobile also generates instant transfer receipts which is sent via mail to the user. The self-service provides more options than many other bank apps such as the ability to adjust your transfer limits.

A limitation of the Diamond Mobile is its rather frequent service interruptions which can be very frustrating when emergency transactions are stalled.

Users’ perspectives

Diamond Bank is considered a new generation bank for the young, trendy and hip. NO surprises that it easily crosses the 1 million downloads bar on Google Play store. The app had almost 13,000 reviews, the highest among this edition’s participants. The average rating is a 4.1 which is ranked as the mid-point rating among this edition’s apps.

A deep dive into the comments show that majority of the unsatisfied customers are complaining about the frequent service interruptions which got them stuck in unwanted situations.

Another popular problem was malfunctioning of the app upon the most recent update.

A feature customers cannot wait to get on the app is the biometric authentication which is the rave of the moment.

As usual, the 5-star comments are filled with one-word comments like smart, great, cool etc. which in no way explain what they love about the app.

A bad habit noticed in the comments section was a lack of response from Diamond Bank customer service staff to the issues raised by their customers.

Sample 5-star comment: “It’s quick, fast and easy to use”

Sample 1-star comment: “The most unreliable app I have ever seen. Very very POOR”

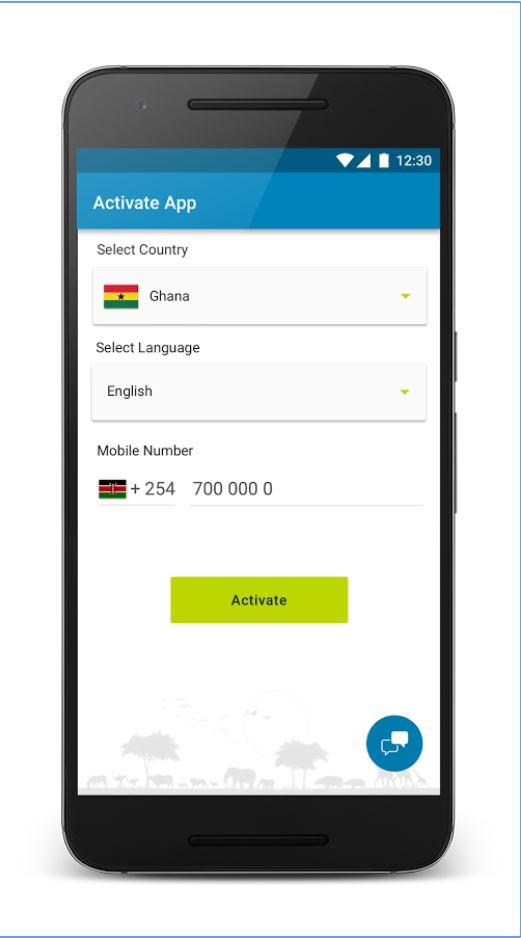

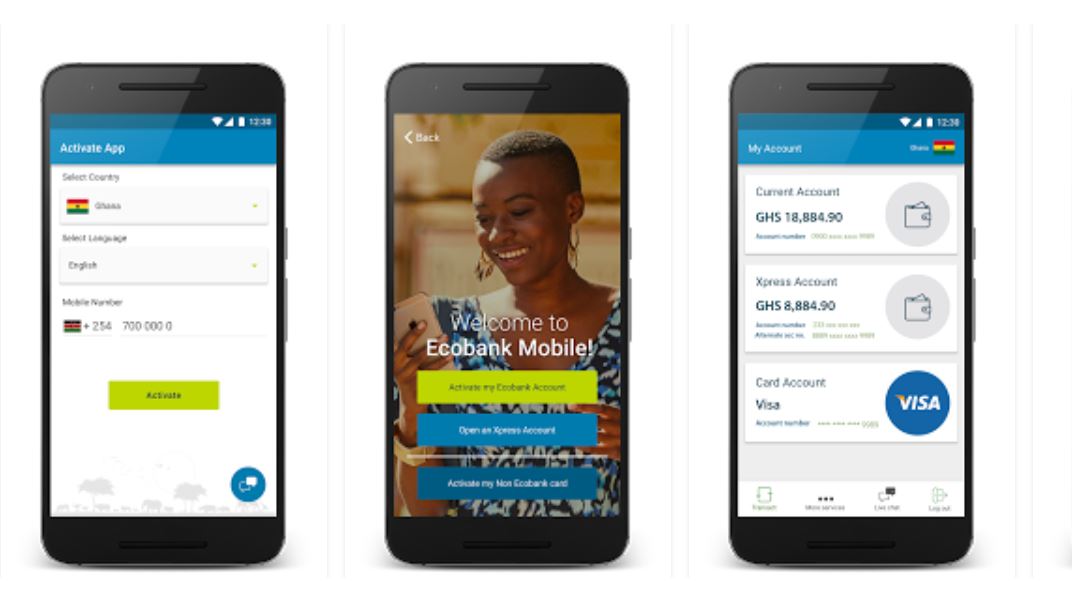

Ecobank

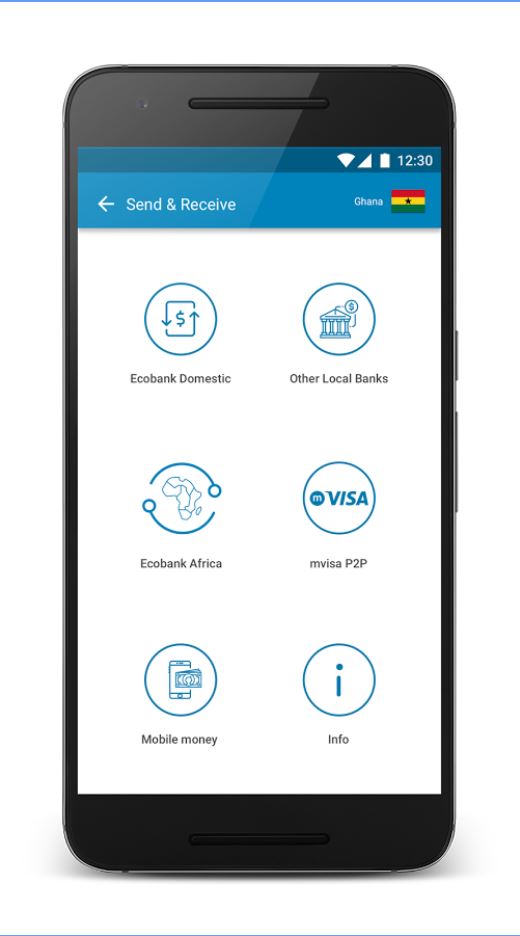

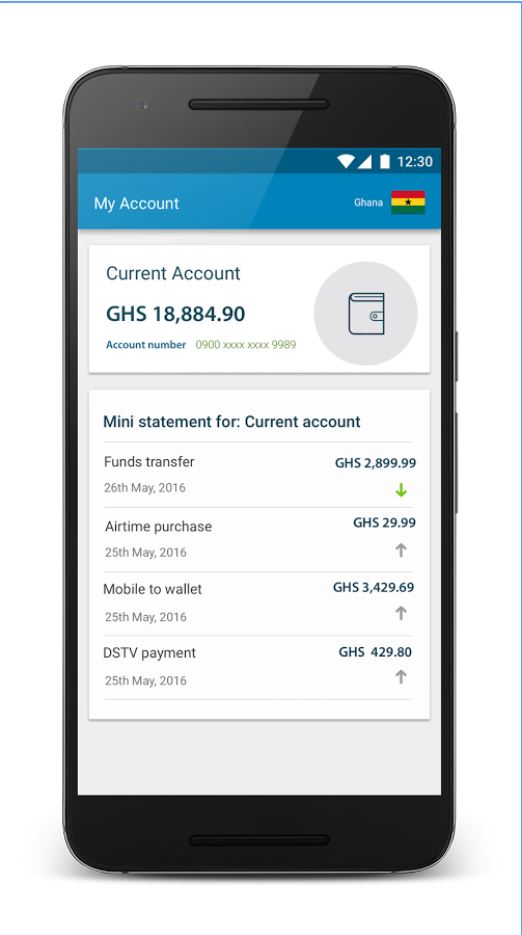

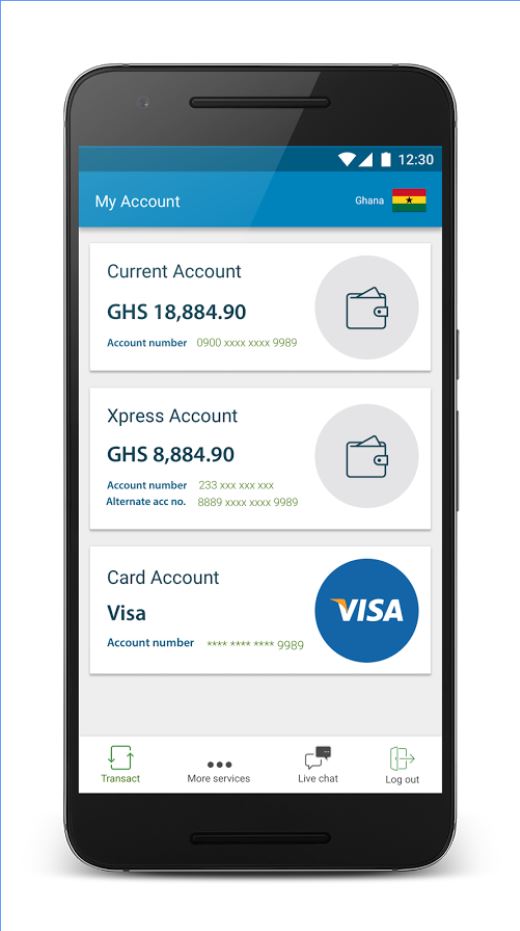

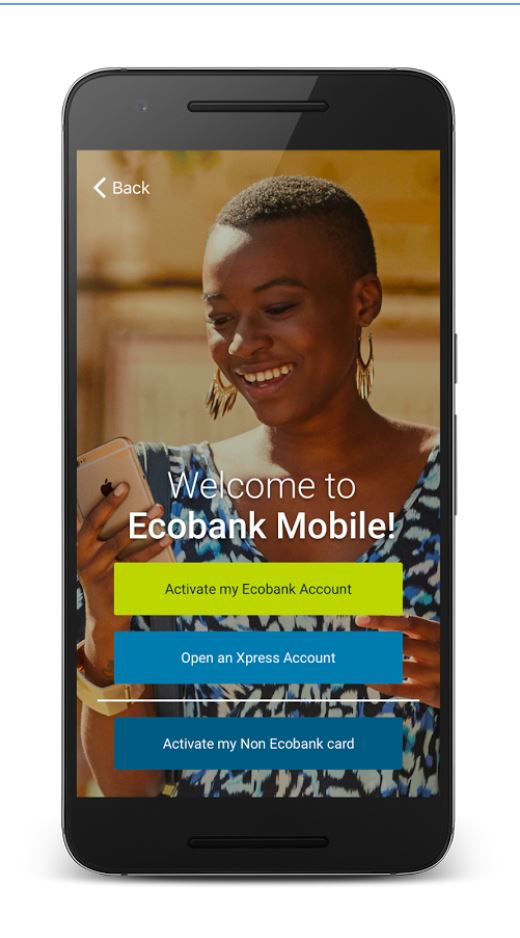

This app came rather later than all the other bank apps. For a bank of this stature, one would wonder why this is so. The most important feature of this app is its ability to synchronize itself with phone’s data.; it is able to access your contact list, short messaging features and other information that may be considered sensitive. It appears the application may, through your phone dialing features, make direct phone calls to customer care.

A note of importance about this app is that you can actually use it to open an account. Although not a full-fledged savings or current account, it is of the nature of a mobile account to sort day to day expenses and bills. The application also caters for Visacard transactions which owing to the international nature of the bank, is a no brainer.

Users’ perspectives

Is it really surprising that the app has just 500,000+ downloads? Not really considering that the bank is not the most popular one in the country. With about 6,200 reviews, customers are not happy with the performance of the app; it scores an average rating of 3.9, the lowest among the apps in this article.

An irritating aspect of the app, especially to data-thrifty Nigerians, is the heavy size (72 MB+) which many will consider excessive.

A common complaint relates to the non-functioning of what was supposed to be one of the app’s greatest appeals- the ability to use other banks’ cards on it.

Another common problem noted were invalid activation codes during signup.

Most of the thumbs-ups the app received were for the normal transactions such as transfers, loading airtime etc. A couple of foreigners using the app give it rave reviews in comparison to other banks in their countries.

Another impressive aspect is that the bank takes time to give personalized responses given to the comments, which in this age of customer-centric service, can only get them into the good books of their customers.

Sample 5-star comment: “Better interface….Good careless cashout at ECOBANK ATMs. Waiting patiently for interpolarity among Nigerian banks”

Sample 1-star comment: “This software doesn’t logout even when you click logout. It only closes the app instead of [logging] out from the software. This is a very high vulnerability”

Based on the above, here our top 5 mobile banking apps for this quarter. Criteria used include usr reviews, overall rating, popularity determined by number of downloads and overall ‘feel’ of the app

4th runner-up: GTB

3rd runner-up: UBA

2nd runner-up: Diamond Mobile

Second place: Zenith Bank

Best app: First Bank

Mobile banking will dominate the future. More physical branches are closing now and now more and more people use mobile apps to conduct their banking transactions. At the same time banks needs to keep up with the latest technology and security features to provide good user experience. This small blog has given a wonder rankings of banking based on their features. <a href=”https://bankingappsguru.com/ target=”_blank”>Best Banking Apps

Mobile banking is the future of banking – As more users opt for conveniences, and swift transaction delivery, the need for banks to make their services easily and instantly available to users can’t be ruled out, no wonder the volume of online payment and transfers keeps growing at double-digit rates year on year.

https://www.nairametrics.com is my favourite mobile banking and finance blogs for every financial technology-related news.